A reality TV gold miner just delivered the kind of blunt warning about Washington’s debt addiction that many career politicians still refuse to say out loud.

Story Snapshot

- Parker Schnabel of TV’s “Gold Rush” says Washington has “zero interest” in fixing America’s exploding debt.

- Schnabel argues rising debt and dollar debasement are driving a massive boom in gold prices and mining profits.

- Gold near $3,800 an ounce and nearly $100 million in seasonal mining revenue signal a broad loss of faith in the dollar.

- The story exposes how years of bipartisan overspending have pushed savers toward hard assets and away from fiat promises.

Gold Miner’s Warning Echoes Grassroots Fiscal Frustration

Parker Schnabel is not a think-tank economist or a Beltway lobbyist, and that is exactly why his warning is resonating with so many Americans. Speaking to Fox’s audience, the “Gold Rush” star said Washington shows “zero interest” in dealing with America’s debt, and that this neglect is eroding confidence in the dollar. For working families who watched prices spiral while politicians printed and spent, hearing that judgment from someone who moves real dirt, not paper, hits a nerve.

Schnabel describes the federal government as “backed into a corner,” arguing that the political class will choose to inflate away the debt rather than confront spending and entitlement reforms honestly. That outlook reflects what many conservatives have feared for years: a permanent D.C. machine addicted to deficits, stimulus, and easy money. When a miner, not a macro PhD, says the only realistic path they see is debasing the dollar, you are hearing Main Street’s verdict on decades of fiscal mismanagement.

Massive Gold Boom as a Vote of No Confidence

The numbers behind Schnabel’s comments are staggering. Reports tied to the current “Gold Rush” season highlight gold around $3,800 an ounce and nearly $100 million in revenue in a single season for the miners. That kind of windfall is not just good television. It is a barometer of fear. Every ounce pulled from the ground and bought by investors represents someone choosing a scarce, tangible asset over another promise from Washington and Wall Street.

Schnabel frames this boom as a “direct vote” against the U.S. dollar, and the phrase captures what many savers feel. After the pandemic-era spending blowout, years of quantitative easing, and Biden’s appetite for trillion‑dollar deficits, retirees and small business owners watched their purchasing power shrink. They may not lecture about real interest rates, but they know the grocery bill. Turning to gold is their way of saying they no longer trust politicians to guard the value of their savings.

How We Got Here: From Fiat Fantasy to Hard-Asset Reality

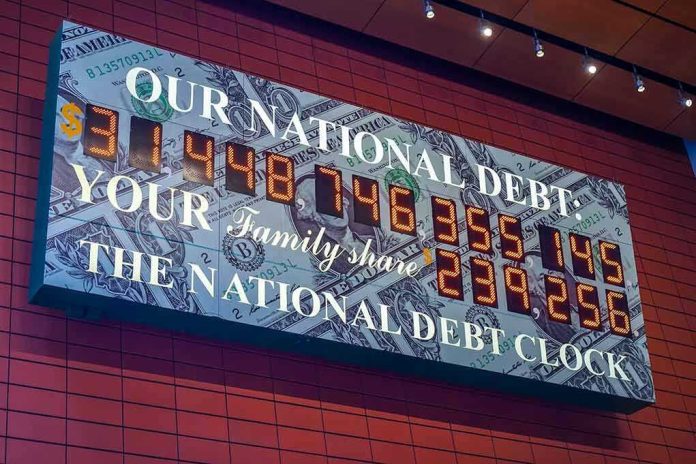

For decades, both parties in Washington treated the debt ceiling like a prop and the Treasury like a bottomless ATM. Bailouts, stimulus checks, bloated omnibus bills, and expansions of government programs piled debt on top of debt. When inflation finally roared after the COVID spending spree, the same crowd shrugged and blamed everything from supply chains to “greed,” rather than their own addiction to cheap money. Ordinary Americans were left holding the bag as their dollars quietly bought less every month.

Meanwhile, gold followed a familiar historical pattern. When currencies are printed freely and politicians duck hard choices, capital gravitates toward real assets. We saw it in the 1970s, again after the 2008 crisis, and now, according to Schnabel’s experience at the mine face, in the 2025 boom. Gold is not magic; it is discipline in metal form. It does not care about polling or partisan spin. It simply reveals, ounce by ounce, how little faith people have in their central planners.

Conservative Takeaways: Debt, Sovereignty, and Personal Protection

For constitutional conservatives, Schnabel’s warning is about far more than commodity prices. Out‑of‑control debt is not just an accounting problem; it is a threat to national sovereignty and individual liberty. A country that cannot live within its means eventually invites higher taxes, financial repression, and pressure to monetize ever more spending. That path erodes the savings of responsible citizens while rewarding the very political class that created the mess, undermining the basic moral contract between government and governed.

‘Gold Rush’ star warns Washington has ‘zero interest’ in fixing the debt, fueling a massive gold boomhttps://t.co/5JFzjo5DYV

— BREAKING NEWZ Alert (@MustReadNewz) December 5, 2025

Trump’s return to office has begun shifting the conversation back toward borders, energy, and growth, but the long shadow of prior fiscal excess still looms. For readers who worked, saved, and played by the rules, the gold boom is a reminder that Washington’s choices have real consequences. You cannot personally stop Congress from overspending, but you can refuse to be the last one holding rapidly devaluing paper. Whether through gold or other hard assets, the message is clear: protect your family first.

Sources:

Fox News Digital video: ‘Gold Rush’ star warns Washington has ‘zero interest’ in fixing the debt